If you know me, it’s no secret if that I don’t go anywhere without a book to read. At the end of the day, I turn to a book to offer a quiet space of calm, a welcome escape that sets me up for a good night’s sleep. Reading makes me feel centred and whole. I like to sit and look at my bookshelf and find the book for that moment, for that frame of mind, for that state of heart. THERE IS A BOOK FOR THAT!

There's a book for that, no matter what!

Much has been written about the importance of books in instilling empathy in young readers, and how reading is the key for children’s success in later life. But can reading also heal? Are books actually good for our mental health?

According to neuroscientist and science journalist Richard Sima, “Researchers are investigating the impact of reading experiences and reporting evidence of promising mental and social health benefits . . . Now practitioners are exploring new models using the literary arts to support mental health in clinics, classrooms, and communities worldwide.”

|

| Young children may have not yet experienced the whole wide world, but they still have big feelings and need ways to process and deal with them. |

We are wired for story. In the early years, the lines between pretend and reality are frequently blurred. Young children are often deeply connected to fictional characters and toys, interacting with them as if they were real. They are naturally drawn to telling and inventing stories in their imaginative play.

For young children fictional characters can seem rea

Reading stories allows children to step into others’ shoes, building neural pathays in their brains that prompt new ways of responding to situations (Tamir, D. I. et al., 2016). The more these new neural routes are used and practised, with each re-reading of the story, the more routine they become. Reading with a trusted adult can help children navigate their own big feelings and experiences, because stories validate children’s experiences and emotions and model new ways of thinking.

|

| Reading together can be healing. |

In this study, researchers proposed that Bibliotherapy could offer a low-cost and accessible way to improve the mental health. How does it work? There are three stages:

Identification: the reader identifies with a story character and bonds with them.

Catharsis: through the story, the reader experiences the conflict alongside the character and how s/he resolves it.

Insight: the reader reflects on their own circumstances in relation to the story – the characters’ emotions, behaviours and conflict resolution model - and considers how they might apply these tools to their own lives.

Bibliotherapy

• validates young readers’ emotions and experiences

• models how to self-regulate, deal with conflict and big emotions

• opens a dialogue using the story as a vehicle for starting the discussion

I recently attended an excellent SCBWI talk by Melissa Manlove, formerly Executive Editor at Chronicle Books, “The Big Feelings Picture Book Workshop: Transforming Your Past Into Reader's Futures”. In the seminar, Manlove argued that “children's emotional lives are as big and as rich as adults’—and that they need stories that honor that and help them to navigate these essentially human experiences.”

|

| All children deserve a wide variety of books to reflect their feelings and experiences. Libraries in schools and communities are essential resources for creating access to bibliotherapy! |

Something Melissa said in her talk resonated with me – happy children are not children who don’t know pain, trauma or difficult situations; they are not children who don’t have big feelings.

All children are dealing with something, small problems – like finding friends or fear of the dark – and difficult, bigger issues – like having lost a loved one, grappling with injustice, or the displacement of war –

But the difference is that happy, well-adjusted children know there is a path to the top of the mountain:

THEY HAVE A BOOK FOR THAT!

#ReadForEmpthy Collection 2024

Stories children them that there is a path, a way forward to get to the other side of the hard, bigger issues. Children need to know that there are ways to slay their dragons, to deal with their problems.

|

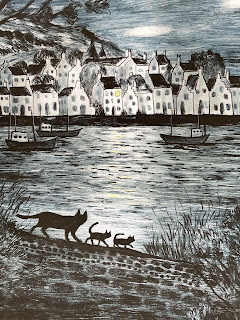

| Stories offer a path - empathy, hope and sometimes solutions. |

Books offer a safe space for exploring big feelings and big or small problems.

Melissa encouraged authors

to not shy away from tackling big feelings and big issues in picture books,

just because they’re for younger readers, but instead to show children the path for how they

might solve and navigate these through story. It is up to us to create the book for

THAT! ⭐

⭐

By tapping into our own big feelings and ways to navigate life, our childhood memories and experiences, and then innovate in a child-centred way, we can create books that will empower and resonate with the young readers of the future. ⭐

⭐

*Find recommendations of books that inspire empathy in the #ReadForEmpthy Collection 2024

*And Books that Help when the Words are Hard to Find on Books That Help

___________

Natascha is the author of the award-winning The Crayon Man: The True Story of the Invention of Crayola Crayons, illustrated by Steven Salerno, winner of the Irma Black Award for Excellence in Children's Books, and selected as a best STEM Book 2020. Editor of numerous prize-winning books, she runs Blue Elephant Storyshaping, an editing, coaching and mentoring service aimed at empowering writers and illustrators to fine-tune their work pre-submission, and is the Editorial Director for Five Quills. Find out about her new picture book webinar courses! She is Co-Regional Advisor (Co-Chair) of SCBWI British Isles. Find her at www.nataschabiebow.com